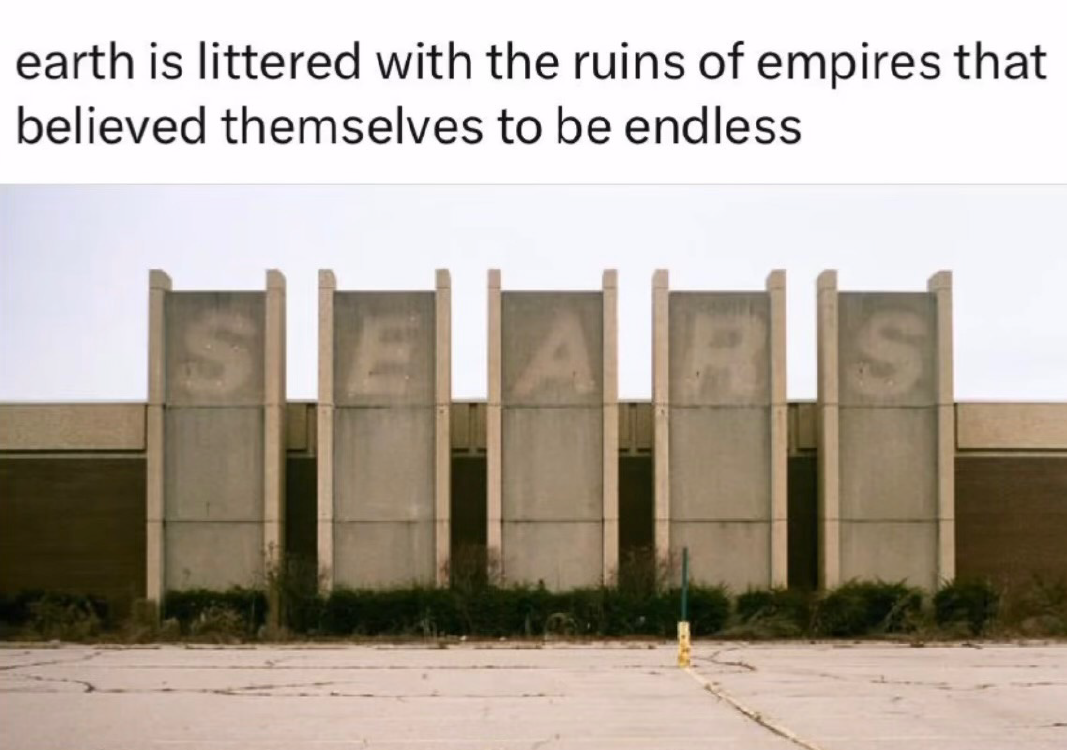

Brookfield bought GGP’s enclosed mall portfolio in 2018 saying that it saw value in the properties by being able to convert most of the 125 assets into mixed-used mini cities with the addition of residences, offices, and hotels. However, 6 years later only 4 of the GGP properties have seen this transformation gain any real traction. With entitlements often hard to come by and a global pandemic throwing real estate values into question, Brookfield has instead pivoted to smaller projects including the redevelopment of over 40 former department store boxes. Meanwhile, the company has also been exiting many of its weaker assets, having sold or surrendered 24 malls with many more in the divestment pipeline. Read more in this story from The Wall Street Journal’s Kate King >>

Lidl, the famed German discount grocer, entered the US market nearly a decade ago. And while the company’s ambitious plans to tackle the US have been scaled back significantly, Lidl has seen some success by establishing a growing customer base in its initial markets that span the East Coast from New York City to Atlanta. With a new leadership team in place, Lidl sees more “untapped potential” to come in America. Grocery Dive’s Sam Silverstein has more in this article >>

Video of the Month: Convenience stores have long been reliant on tobacco and gasoline sales for profits, but as Americans buy less of both the industry is looking at how it can reinvent itself for the future. Enter 7-11, an iconic American brand owned by a Japanese firm, where they’re known more for ready made foods and diverse snacking options. Will Americans embrace the Japanese style convenience model? Find out more in this Wall Street Journal video >>

It’s not often that a major new retail concept debuts, and it’s even more rare when the first location is just a 15 minute drive from my house. However, that is what happened in May when Wayfair opened their first non-clearance brick & mortar location in the Chicago North Shore suburb of Wilmette.

For those who are unfamiliar with the brand, Wayfair is the leading online retailer of furniture and home décor. The company grew to $12 billion in revenue but has seen sales flatten since the pandemic home spending cycle ended.

As shopping center owners, we often purchase assets in places we don’t live. We lease these centers from remote locations and our relationships to the community are tenuous at best. While the nature of large scale shopping centers means there will always be a greater focus on national and regional chains and a demand for higher rents, as an industry we could all probably do a better job of finding out what makes each community unique and scaling our plans to make each asset at least somewhat tailored to local interests.

The pivot to physical retail comes after years of planning and Wayfair hopes it will launch the company into a new era where it becomes a top tier destination across a wide variety of income brackets.

The Wilmette store is in a 150,000 square foot former Lord & Taylor department store box. The exterior of the store was renovated with plenty of windows letting in natural light that helps better highlight how furniture might look in someone’s home. The store also includes a café with healthy dining options, home appliances, lighting fixtures, pet furniture, mattresses, candles, and just about anything else you’d want to put in or around your house.

One feature that we loved was the plumbing section where you could try out roughly 3 dozen different faucets and a shower wall that showed the spraying styles of a variety of shower heads. It’s an interactive an experiential element that was drawing the most crowds of any part of the store. Speaking of crowds, the store was packed on a rainy summer Sunday afternoon, so much so that it may have been hard to locate someone to help with any larger purchases. In addition, it could be hard to differentiate between sections that were more showroom-like and those more like a traditional retail store. We were interested in buying a new garbage can, but the one we liked was not on the shelves.

Ultimately, we didn’t buy anything on the trip, but we did get several ideas for new bedroom furniture for our daughter and bought a new bed and dresser from the Wayfair website a week later. In that sense, the store created an incremental sale as we likely would have ended up at a more traditional furniture store had we not made the trip to Wayfair.

Overall, the store reminded me of a cross between an Ikea and the now defunct Great Indoors (a Sears concept from the late 1990s). Whether Wayfair ends up more like the former or the latter will likely depend on how they are able to leverage the strengths of this initial rollout while addressing the (admittedly few) missteps.

Mike Jordan

Listen to the Song of the Month

Listen to the Song of the MonthHall & Oates are the most successful musical duo of the last 50 years. They were inducted into the Rock & Roll Hall of Fame in 2014 on their first nomination and have left behind dozens of indelible hits spanning 3 decades. In 1984, their album Big Bam Boom was the first album I ever bought and helped set me on a lifetime path of being a musically obsessed nerd who has spent countless hours in record stores all over the country. Their blending of rock, soul, pop, and folk helped expand my musical palette. They’ve been in and out of style over the years, and sadly no longer perform together. However, they still sound as fresh to me today as they did 40 years ago. Here’s one of my favorite songs of their MTV era “Say It Isn’t So” from 1983. Listen Here >>