By: Eric Zimmermann and Mike Jordan

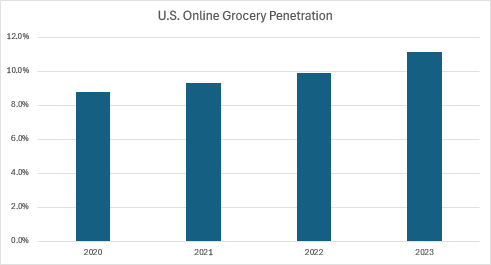

Open-air shopping centers have become the primary retail destination for most American consumers as they provide value and convenience to American consumers. Open-air shopping can encompass a wide variety of formats: grocery anchored (or neighborhood) centers, power centers, convenience centers, lifestyle centers, and street retail. In the 2010s, investors shied away from most retail formats based on the mistaken belief that online shopping would dominate consumer behavior in the years to come. Grocery anchored centers were the exception to this as online shopping in the grocery space had yet to reach a tipping point, with overall penetration at around 11% as of 2023. Furthermore, given that the vast majority of online grocery sales are fulfilled from a local store, the threat to the underlying real estate is reduced.

Source: eMarketer

However, at Big V, our focus has been on large format power centers. This might seem counterintuitive. After all, since the Great Financial Crisis many retailers have shut their doors, including Toys R Us, Circuit City, Linens N Things, Bed Bath & Beyond, Borders Books & Music, and Stein Mart to name just a few. But that was then, and we believe that the fundamentals of retail real estate have shifted to favor the power center format in the post-pandemic era. Over the coming months, we will be exploring the reasons behind our conviction in power centers with an in-depth series as part of Insights on the Margin – our new executive thought leadership platform.

Perhaps the biggest factor in the power center thesis is that the supply and demand landscape for this type of product has rarely been so favorable. Much of the vacant space that was created when the above retailers liquidated has already been leased up at accretive rents, leaving just 4% of all retail space vacant as of 2024. With increasing construction and entitlement costs, very few new power centers have been built since 2009, this has driven rents higher and created fierce competition among retailers for the best locations. Tenants driving this demand include off-price stores like Ross, the TJX banners, and Burlington, along with specialty brands like Five Below, Ulta, and Boot Barn. There’s also been a surge in outparcel development from fast-casual restaurants like Chick-fil-A, Cava, and Chipotle – who all want to be close to dominant anchored assets. Having so many retailers chasing so little space has helped to drive rents upward, and there’s little new supply coming online in the coming years to satisfy this demand for new space.

Other factors we will dive deeper on include the relative creditworthiness of big box tenants, a coming surge in lease expirations, and the potential for greater returns given the high cost basis of neighborhood centers. We’ll also be taking a look at the changing nature of the grocery sector and why power center tenants are primed to take market share from traditional grocers. We’re excited to share these insights with you as we meet American consumers where they are at: your local power center.