While omnichannel retailing has meant an increase in store technology, one iconic French retailer had the opposite idea in mind when planning their entry into the American market. Printemps New York, located at the base of the historic One Wall Street building thinks that it can differentiate itself with more face to face customer service and a website that encourages shoppers to visit the store in person. Read more in this article from The Wall Street Journal >>

New retail development has been scarce since the Great Financial Crisis, but one Arizona-based developer sees big opportunities in building shopping centers amid the lowest vacancy levels in history. SimonCRE has over 1.5 million square feet of new space planned over the next year in markets all over the country. By focusing on municipal incentives to offset rising construction costs, Joshua Simon is betting that the time for new construction is now. Read more from Kate King at the Wall Street Journal >>

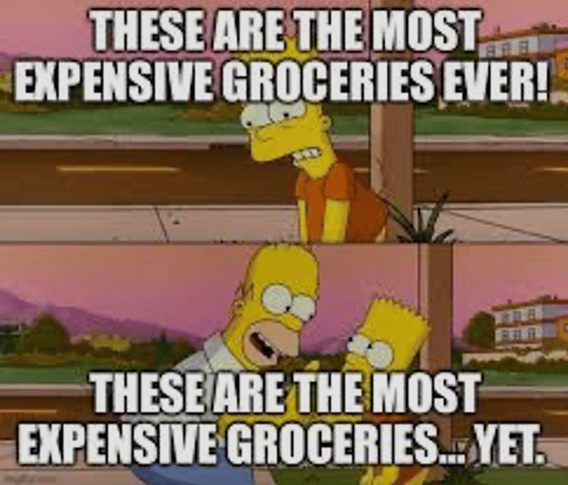

Video of the Month: With the threat of higher inflation as a result of tariff policy, many consumers are “doom spending” – buying things now in anticipation of higher prices and supply shocks down the road – however, in the face of rising consumer debt and recession alarms, will this lead to an even bigger downturn in the months ahead? Find out in this video from CNBC >>

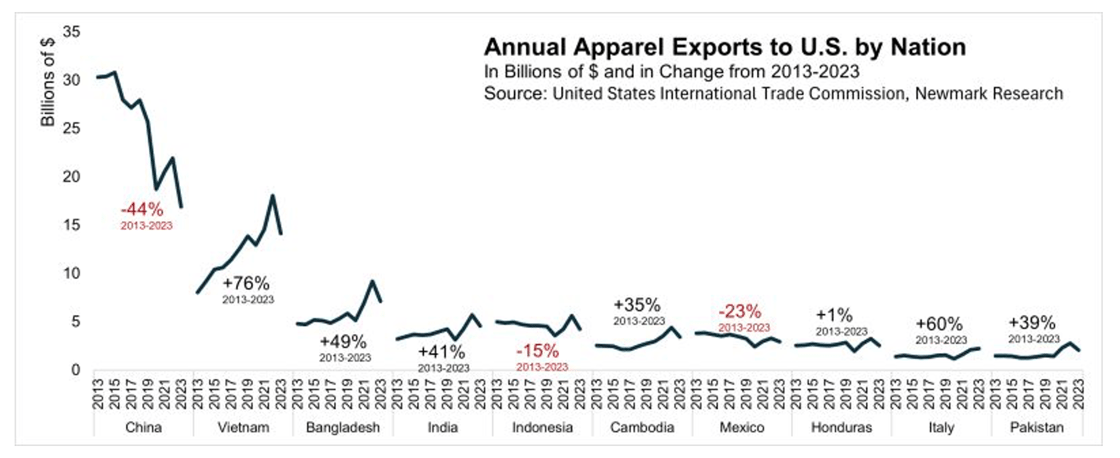

With consumer anxiety about the economy more pessimistic than ever, one thing most people can agree on is that shopping patterns are about to undergo a seismic shift for the second time in the last decade. While winners and losers will emerge among national chains based on how well each brand adapts to the coming changes, one retail category may already be poised to take market share, and in fact, has been quietly growing in prominence over the last few years: vintage and resale goods.

Vintage retail spans a wide variety of categories from a charitable thrift shop to a curated high street boutique. There are over 25,000 resale stores in the United States, and while online sellers like ThredUp and Depop continue to be popular, most thrift gremlins prefer to find the best deals and unique items at brick & mortar stores.

Secondhand apparel sales grew 14% in 2024 to $49 billion, outpacing the broader apparel market by a factor of five! This trend has been building throughout the decade since the pandemic, with secondhand sales growing at a $6 billion CAGR. Meanwhile a recent Capital One survey found that over 33% of clothing purchased in the US was secondhand and nearly 60% of consumers buy at least some of their clothing secondhand. That number grows to nearly 3/4th among younger generations, while half of Gen Z consumers shop vintage first before looking for items at a traditional retailer. Current projections show secondhand apparel will reach $75 billion by 2029. Vintage shopping is also a sustainable and affordable alternative to fast fashion which has been under increasing scrutiny for its negative environmental impact.

While shopping may take place in brick & mortar stores, many young people are learning how to spot the best finds through online media channels. Kathleen Martin, a thrift store enthusiast from Columbus, Ohio, runs the popular YouTube channel Katheleen Illustrated and posts about her weekly thrift hauls, fashion inspirations, and creative ways to upcycle or add individual flare to thrifted threads. One recent video saw her locked in an Ohio thrift store overnight, while others focus on crafting and encouraging viewers to find their personal aesthetic. Her creative and approachable style fits in line with a younger generation who are increasingly rejecting the unrealistic perfection and unattainable lifestyle of mainstream influencers.

Thrift stores may have been around for decades, but in what may be an era of increasing supply chain disruption and a backlash against a tech driven, impersonal society, thrift shopping may have finally found its moment in the sun.

Mike Jordan

Listen to the Song of the Month

Listen to the Song of the MonthTaking a trip to Ikea is a rite of passage for many young couples. Can two people handle 200,000 square feet of sensory overload and meatballs without resorting to hating each other? Indie rock giants Pavement tackled the topic on their 1997 album Brighten the Corners with this jangly power pop gem.