Amazon unveiled plans to lay off as many as 11,000 employees with a focus on its retail operations and device division, along with human resources.

Moody’s this week lowered Texas-based At Home’s corporate credit rating from B3 to Caa1. Moody’s also downgraded the retailer’s probability of default and its senior secured first term loan, as well as secured and unsecured senior notes. The firm maintained At Home’s stable outlook.

Chipotle is building a real estate pipeline to accelerate new unit growth with an emphasis on Chipotlanes, the company’s drive-thru format for digital order pickup. Next year, the company plans to open between 255 to 285 new restaurants, with at least 80% including a drive-thru lane. Chipotle has long-term plans to more than double its store count from 3,100 to 7,000.

Dutch Bros. Inc. is on track to meeting its store expansion goal. The fast-growing coffee chain said it is targeting at least 150 new shop openings for 2023. The openings would enable Dutch Bros. to reach its

goal of 800 shops by the end of 2023. The company noted that it opened a record 38 locations across 11

states during the quarter, which is almost as many as it opened during the entire year of 2019.

Maurices, the women’s fashion brand, is opening three stores for its tween brand Evsie in West Jordan, Utah; Fargo, North Dakota; and Boise, Idaho. The brand will also be available at six Maurices locations and more than 240 shop-in-shops across the U.S., making it available at almost 800 locations in the U.S. and Canada.

Party City’s credit was further downgraded by Fitch to CCC from B-, citing “rapid deterioration” in Party City’s operations and liquidity and calling its capital structure “likely untenable.” The ratings agency notes that with Party City unlikely to improve operations before its 2025 maturities, some type of restructuring has become more probable. In order to address these concerns, the company is moving forward with a $30 million cost-cutting plan to offset the impacts of lower demand and inflationary pressures. The company will cut its corporate workforce 19% and is looking to reduce costs associated with raw materials, logistics and operations. Party City appointed ex-Carter’s executive Pete Smith as COO to execute this strategy.

Primark is opening 3 new stores in the New York City region before the end of the year as it plans to grow to 60 U.S. locations by 2026 (the brand currently has 14 U.S. stores open). Primark is known for its extremely low prices. The retailer’s assortment includes women’s, men’s and kids fashion, as well as beauty, homeware and accessory items.

Sally Beauty Holdings is accelerating its store optimization plans. The company said it plans to close approximately 350 stores during December 2022 amid ongoing efforts to improve its profitability. Most of the store closings will be in the United States, where it has over 4,500 locations.

Simon is looking to help direct-to-consumer brands evolve into omnichannel retailers by expanding in brick-and-mortar. The mall operator is teaming up with Leap to open multiple stores at its properties for direct-to-consumer brands. The featured brands include True Classic Tees, which will open at Del Amo Fashion Center in Torrence, Calif., and ThirdLove, Sugarfina, and Goodlife, which will open at Town Center at Boca Raton, Fla.

Target debuted a new prototype for its full-size format at a newly opened store in Katy, Texas. The new store is 150,000 square feet – over 20,000 square feet larger than its current footprint. Target plans to focus on growing its full-sized store fleet, while also continuing to pursue small-format stores in the coming years. By 2024, all of Target’s new stores and remodels will feature these reimagined design elements. << See a sneak peak of the new design here >>

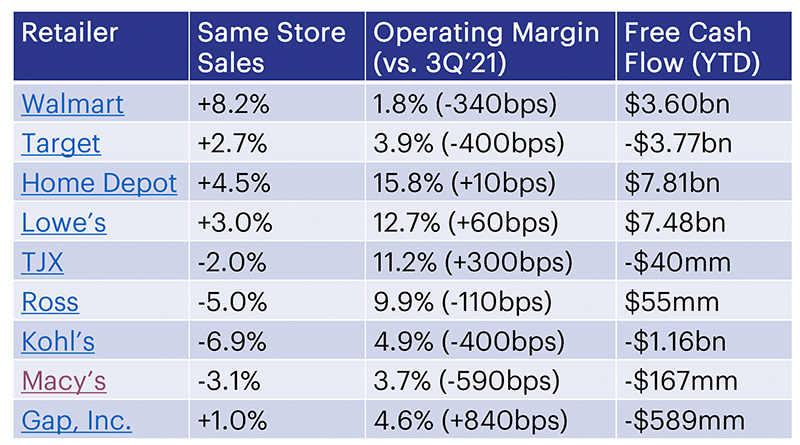

Most major retailers released their quarterly results last week and it looks like a mixed bag for Q3 as consumers were starting to feel pinched by inflation and retailers are discounting more than ever to relieve an inventory glut caused by overbuying during the 2021 supply chain crisis.

Notable callouts include Walmart’s stellar results vs. Target. This is a battle that Target won handily over the past 2 years as their omnichannel initiatives gained traction with consumers. This reversal is due in part to Walmart’s higher share in the grocery category (50% of WMT sales vs. 20% of TGT sales) along with the “trade down” effect that accompanies most economic turbulence and Target’s major inventory missteps. Target also guided their Q4 below Street estimates, though they remain positioned to be a long-term winner.

Elsewhere, investors rewarded Macy’s for being perhaps the one retailer who enters the Holidays with a defensible inventory level. Beneath the hood however, there are still issues to address with sales momentum and margins. Those issues are even greater with Kohl’s, a company that had once been able to buck department store trends pre-pandemic, now finds itself scrambling to address the same issues that have plagued their peers and pulled their full year guidance following a lackluster quarter.

For more analysis, check out the articles below: