Retail theft is on the rise both from petty thieves and organized crime syndicates. According to a recent survey, frontline managers are feeling the heat with nearly half seeing an increased amount of customer violence in the last 30 days alone. Meanwhile, stores aren’t the only targets of retail criminals, as much of the organized theft is done in the retailer’s supply chains to the tune of an estimated $94.5 billion annually. For a sobering look at this issue, click here to read this white paper by Andres Jola-Sanchez from the Bush School at Texas A&M University.

Pickleball was invented in the 1960s near Seattle, though until about 2018 very few people had ever heard of the sport. Since then, roughly 9 million people have joined in the craze, making it “America’s Hottest Sport” according to Business Insider. As the game’s popularity grows, so will its impact on retail. Walmart tripled its shelf space for pickleball merchandise, while everyone from Lululemon to Tory Burch have seen a spike in sales of pickleball appropriate attire. Perhaps most intriguing for landlords is Picklemall, a startup that aims to locate indoor courts inside ailing malls amid a call for nearly 26,000 additional courts nationwide. To read more about how pickleball is impacting retail, check out this article from Dennis Limmer in Retail Wire >>

Video(s) of the Month: While the feds decide whether the proposed Albertsons/Kroger merger will create unfair competition in the grocery landscape, it turns out that neither company is even half the size of America’s largest grocer: Walmart. To find out more about how the retail giant won where so many others have struggled, check out this video from CNBC and if you’re looking to add some wholesome humor to your day, I think comedian Kate Micucci’s tribute to grocery stores of all kinds will do the trick >>

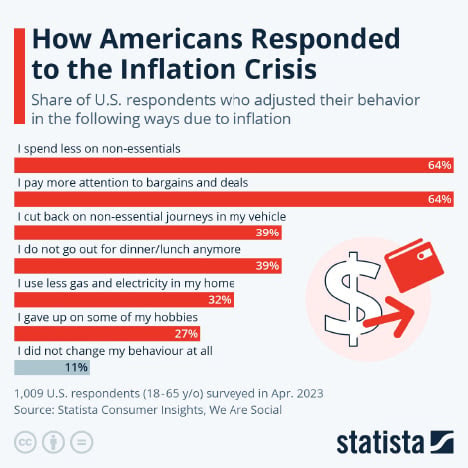

While retail spending remains historically strong, leading indicators are increasingly showing Americans adjusting their spending habits in the wake of high inflation.

Listen to the Song of the Month

Listen to the Song of the Month