With the new year upon us, it’s worth looking at what changes and challenges will be facing retailers and consumers in 2024. With that in mind, here are a few articles that look at the shape of shopping to come:

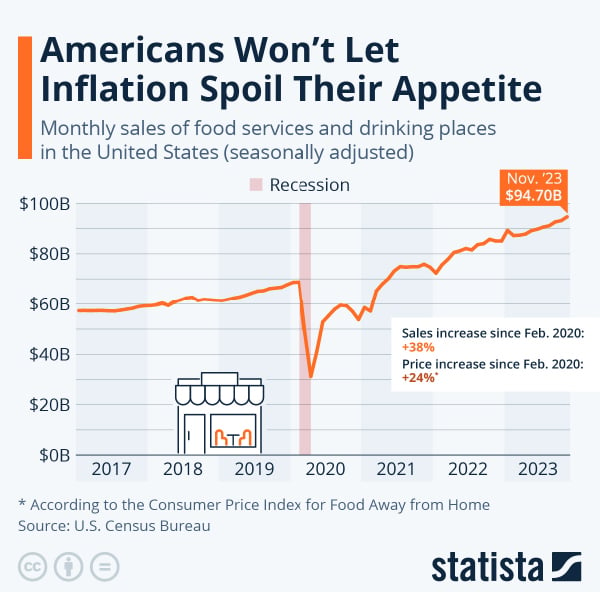

As restaurant sales continue to climb even in the face of inflation and shaky consumer confidence, one of the biggest factors “driving” the surge has been restaurant owner’s renewed zeal for the drive thru lane. Many large chains are redesigning their prototypes to be more accommodating to take out orders and de-emphasizing the dining room. Dine-in orders at fast food restaurants are down 47% from where they were pre-pandemic, while the drive-thru lane accounts for 2/3rds of all fast food revenue. Find out more in this piece by Kim Severson of the New York Times. Read More >>

Video of the Month: Trader Joe’s cult-like following may not make sense for the uninitiated, but to those in the know it’s a shopping experience unlike any other. Find out how this California company hit on a formula for success by zigging while the rest of the industry zagged in this video by Weird History Watch here >>

Listen to the Song of the Month

Listen to the Song of the MonthThe year in music for 2024 is getting off to a great start with this new single from Katie Crutchfield’s Waxahatchee project. From her beginnings in punk bands to performing with Wynonna Judd and covering Lucinda Williams on the Ryman stage, Katie’s evolution as a singer and songwriter is evident on “Right Back To It” where she’s joined by North Carolina-based guitarist MJ Lenderman. Together, they have created a sound as sweet as sweet tea and harmonies that will warm you like a blanket in winter. Waxahatchee’s 6th album Tiger’s Blood is out March 22nd. Listen here >>