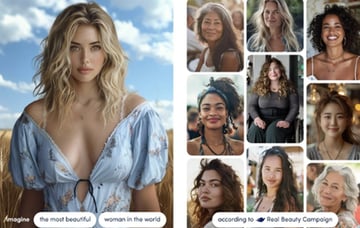

Artificial Intelligence seems to be taking over more and more aspects of today’s consumer landscape; however one prominent brand is fighting back. Dove beauty, a division of Unilever, has unveiled a new ad campaign called “The Code” which shows how AI tools perpetuate unrealistic beauty standards along with a pledge to continue using real women in all its marketing images. Read more >>

At the height of the COVID pandemic, one trend that received an inordinate amount of hype around its ability to change how restaurants operate was “ghost kitchens”. As more people refrained from dining out, several restaurant brands began opening kitchens with no consumer facing storefronts that would prepare orders for delivery services like GrubHub and DoorDash. Some brands even hatched delightfully devilish plans to create fake identities to disguise their food as an authentic local startup. Flash forward to 2024, after billions have been invested in the space and firms like CBRE had predicted ghost kitchens would account for over 20% of restaurant sales and the concept has seemingly lost all traction. Read more in this article from the New York Times Julie Creswell >>

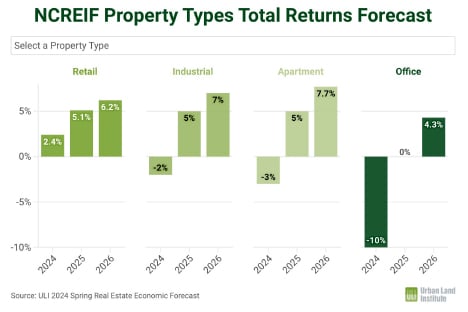

The Urban Land Institute held their annual Spring conference in New York City last week amid the latest news that inflation reduction is stagnating in the mid to upper 3% range. While this doesn’t bode well for major interest rate cutting this year, all signs point to increased transaction volume over 2023, while setting up the industry for better times in 2025-26. To read more takeaways from the meeting, click here >>

Looking over the latest retail news this month and one picture about the state of shopping in 2024 is clearer than ever before: the more things change, the more they stay the same. While technology has undoubtedly changed the way Americans live, work, and shop the adage “if it ain’t broke, don’t fix it” still seems to be true.

Kroger’s partnership with the UK company Ocado, which had revolutionized grocery delivery in its home country with innovative robotic distribution centers, was one of the most heralded stories of 2018. Kroger believed so much in the competitive advantages of the technology that they began opening Ocado-based “sheds” in markets like Miami and Austin where the grocery giant has never had a physical store presence. Kroger hoped that Ocado’s convenience and speed would give them market share in places where people had never shopped them before. It turns out that didn’t materialize in a profitable way as customers weren’t interested in buying food from a retailer they couldn’t shop and see in person. As my research colleague Nicole Larson at Colliers put it in a recent LinkedIn post: “For brands eyeing sustainable growth, diversifying into physical retail is not merely an option – it’s an imperative.”

The grocery tech world was rocked again when Amazon announced it was pulling its revolutionary “Just Walk Out” technology from all its full-sized Amazon Fresh locations. The Fresh banner has been a rare misstep for the online behemoth that once hinted it could open as many as 600 Fresh stores by 2023. Today, with less than 50 open and many more projects built out but sitting vacant, Amazon has gone back to the drawing board and erased the primary differentiator between Fresh and other grocers: the ability for a customer to take things off the shelf, be charged for them immediately, and then walk out without ever going through a checkout lane. The stores were outfitted with hundreds of cameras and servers and cost as much as $4mm per store in technology capital expenditures alone. But after all that money was spent, the cameras never worked as intended. Over 70% of transactions had to be reviewed by a team in India before charging the customers which not only was wildly inefficient but raised serious privacy concerns to boot. While the company is now hoping to test a new cart-based scan & go system at its stores; customers have remained loyal to their market leading grocery brands.

In this months “Big View”, I’ve also included an article about the decline of ghost kitchens from The New York Times. Immediately after the pandemic, restaurant brands seemed to be in a mad dash to minimize dine-in options and maximize their footprints for the burgeoning app-based delivery market. However, apps like DoorDash and GrubHub have been largely unprofitable resulting in higher fees and a trend in post-pandemic behavior that emphasizes the social element of dining out, even if it’s just a lunch at a local fast-food restaurant. We want to be near people, and we want to know where our food comes from.

It’s worth remembering all these failures and pull backs as we read about the next big tech hope: artificial intelligence. I have no doubt that there will be major breakthroughs and game changing applications of this technoliogy but we need to be wary of “clever” solutions in search of problems no one is asking to be solved.

Mike Jordan

Listen to the Song of the Month

Listen to the Song of the MonthKarl Wallinger was the creative genius behind the UK-based art-pop project World Party. Following his time in the band The Waterboys, World Party had a string of alternative hits on both sides of the Atlantic in the late 80s and early 90s. Sadly, Wallinger passed away last month after a long illness at the age of 66. World Party’s music started with a heavy helping of Beatles influence, the jangling guitars of the Byrds, and the paisley patterned 80s funk of Prince mixed in with socially engaging lyrics like that of their 1993 hit “Is It Like Today?” which ponders the very nature of pondering the human existence - from the ancient Greeks to the Apollo astronauts. Listen Here >>