April came in at 4.9%, the lowest annual pace since 2021

Housing costs and rising gas prices presented the biggest obstacles to getting inflation closer to the Fed’s target of 2% Read more >>

Adobe: Online prices fell 1.8% annually Read more >>

Kearney: US Executives see positives in current cycle Read More >>

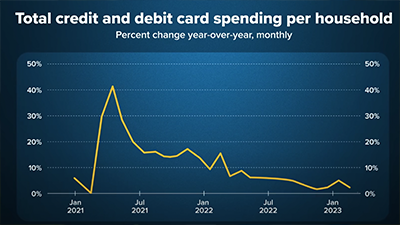

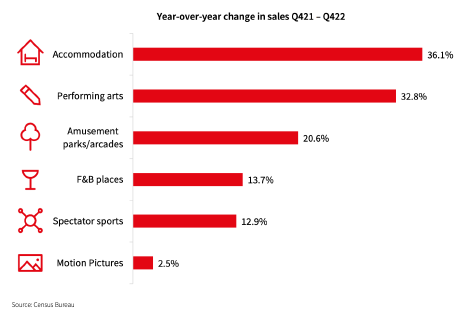

NRF: Consumer spending remains robust despite inflation Read More >>

After stalling for months, the troubled retailer filed on April 23rd Read More >>

How Bed Bath’s soured relationship with suppliers hastened the downfall Read More >>

JLL’s Naveen Jaggi: Why Bed Bath stores won’t be empty for long Read More >>