Retail theft has been on the rise over the past few years and the problem is now bad enough that many of the nation’s largest chains are warning that the issue is having a material impact to the bottom line. On its most recent earnings call, Target noted that shrink would cost the company $500mm in 2023, while Ulta cited shrink as a reason for lowering its margin guidance. Shoplifting is not a new phenomenon, but the rise of organized retail crime is. With the ability to resell just about any product online at rock bottom prices, professional thieves have been causing havoc and creating a dangerous environment for store associates and customers alike. Here is the latest on this disturbing trend:

As the world comes to better understand neurodiversity and the needs of people on the autism spectrum, more thought is being put into how to make the world a more accommodating place for people and families living with hidden disabilities. Mesa, Arizona is hoping that it may have found the answer to increasing inclusivity by becoming the world’s first Autism-Certified City. To obtain this certification, Mesa trained its public-facing employees and designed its tourist attractions with the needs of the neurodiverse community in mind. Now, other cities (including High Point, NC, Visalia, CA, and Toledo, OH) are getting in on the trend too. Read More From the BBC Here >>

Video of the Month: While the potential threat of artificial intelligence to take over a number of jobs in the white-collar world has been receiving a great deal of attention lately, when it comes to retail and restaurants robots and other automation tools are beginning to work their way from the factory to the kitchens and selling floors of many businesses. Watch more below in this series from CNBC to find out why you might find a robot scanning the inventory on your next grocery shopping trip:

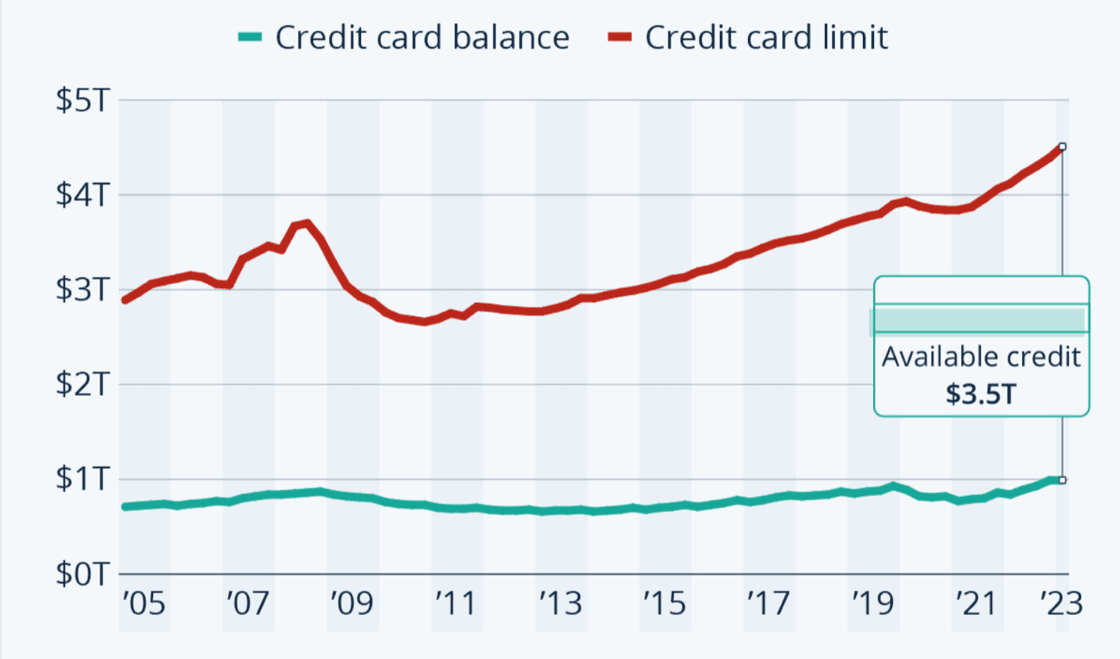

Some economists have pointed to mounting credit card debt as a reason why retail sales were able to withstand the inflationary headwinds we’ve seen over the last 18 months. However, when it comes to plastic, we still have a long way to go before we are maxed out. Is this a sign of consumer strength, or a warning that many may start overcharging their way to financial woe in an age of high interest rates?

AMERICANS FAR FROM MAXED OUT ON CREDIT CARD DEBT

U.S. consumer credit card balance and limit

Source: New York Fed Consumer Credit Panel/Equifax

Listen to the Song of the Month

Listen to the Song of the Month