Taylor Swift is quite the opposite of an “anti-hero” when it comes to boosting the US economy in 2023. Business Insider reports that Swift’s Eras Tour is estimated to generate almost $5 billion in consumer spending. As one economist observed, if Taylor Swift were a country, her GDP would be larger than 50 other sovereign nations. Michael’s stores reported a 40% increase in jewelry making kit sales as Swifties prepare for each concert with beaded bracelets. Even the Federal Reserve shouted out Miss Americana in their report noting that Swift’s shows in Philadelphia contributed to the best month for hotel revenue since the pandemic. Read more about just how big the Eras Era has become >>

Publix is practically an institution in Florida (see this month’s retail meme of the month for an example). As they’ve methodically branched out to other Southeastern markets, reaching as far north as Louisville, KY; more and more Americans are doing their grocery shopping at this legendary chain that puts customer service at the forefront and harkens back to a simpler, less tech-intensive time in American consumer life. Vox’s Emily Stewart spent several days in Florida to find out what all the fuss is about and whether Publix lives up to the hype. Read More >>

We all know REITs are a huge part of our business, but what exactly is a REIT and how is it different than other types of real estate holding companies? In this video from CNBC, find out just how REIT structures work and who the biggest players are in this $4.5 trillion segment. Watch here >>

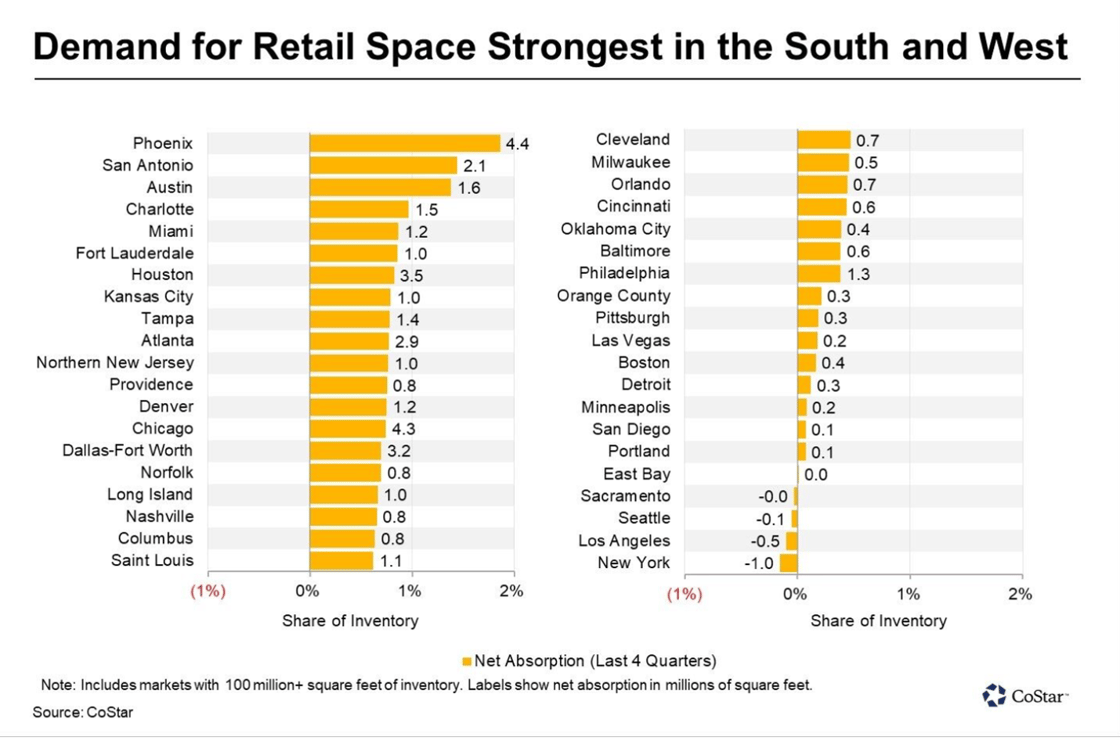

As retail demand continues to outpace supply, it’s instructive to look at where net absorption is heaviest to understand where rents will grow fastest. Unsurprisingly, Sun Belt cities dominate the list while a select few Northeastern (Providence, Northern NJ) and Midwestern (Kansas City, Chicago) markets are starting to show increased strength. The weakest geographies continue to be high-cost coastal markets which have seen population growth stagnate in the post-pandemic environment.

Listen to the Song of the Month

Listen to the Song of the Month